NFTs: What to know and how they can empower the African art market?

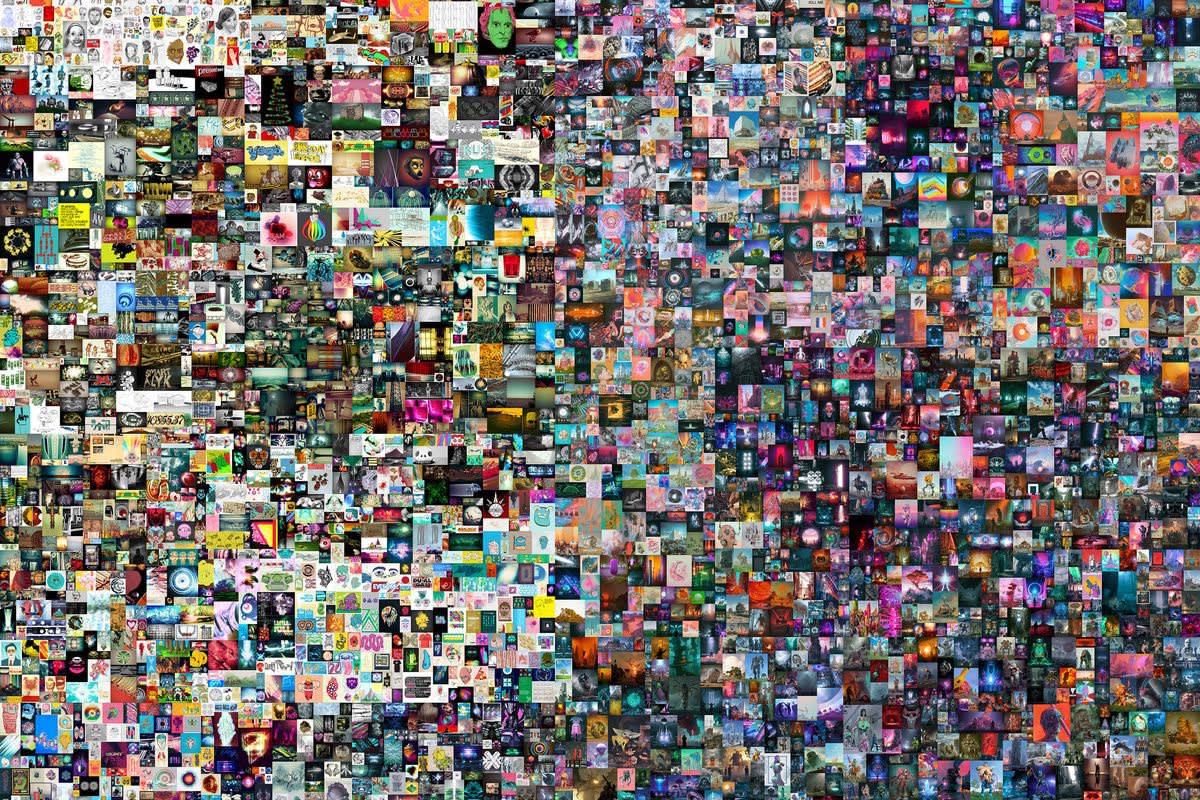

If you’re a lover of art, you have more than likely come across the term ‘NFT’ in the past few months. From the record-breaking sale at Christie’s of Beeple’s artwork Everydays: The First 5000 Days—the first purely digital artwork offered at the esteemed auction house, sold for $69 million—to independent artists raving about the trend, there’s a lot of noise surrounding this notorious topic.

Beeple’s collage, Everydays: The First 5000 Days, sold at Christie’s. | Image: Beeple

The team here at Pavillon54 have compiled some of the most common questions surrounding NFTs, and have provided our clearest, most concise answers. Read on to learn all about this art-world phenomenon that has received so much press coverage in recent months, and why it could be a gamechanger for the African art market.

What is an NFT?

Put simply—an NFT (Non-Fungible Token) is a digital asset that represents a real-world object such as an artwork, music, in-game items, or videos.[1] In the art world, these can be JPEG files, videos, or even a meme or a Tweet, but the key difference between an NFT and any other image on the internet that you can screenshot, is that an NFT is associated with a record of a transaction on the blockchain. This record acts as a digital Certificate of Authenticity, and thus transparently records an action, such as every time an NFT is traded, or who the original creator is. Like artworks on the physical art market, NFTs can be bought as an investment and resold for profit or collected and kept.

Twitter founder and CEO Jack Dorsey’ first ever tweet in 2006. Even though the tweet will continue existing on Twitter, the tweet was sold as an NFT to Sina Estav, CEO of Bridge Oracle for $2.9 million NFTS Street reported.

Why is it important for the art market?

The traditional art market has struggled to fully integrate digital artworks and their creators into the structures of the business of art. After all, digital works, as opposed to physical paintings and sculptures, are more difficult to display, arguably more difficult to enjoy, and are more-easily replicated. Authenticity and pirating have been huge concerns regarding digital artworks for many years. The rise of NFTs and blockchain technology have relieved many collectors of these concerns through their transparent nature and through the ability to validate the authenticity of a digital artwork. Though NFTs have been around for almost a decade, they have become popular in their current form as an art world asset only in the past few months. The COVID-19 pandemic undoubtedly influenced this shift in mentality towards digital artworks, as the whole art market structure was forced to move online. This came hand-in-hand with a more open mindset towards digital artists, who up until recently had been largely side-lined by big institutions, resulting in the record-breaking Beeple sale at Christie’s. In many ways, the sale of Everydays: The First 5000 Days cemented the idea that NFTs—and by extension digital artists—could become important, sought-after artworks in the art market at large.

Doge, the image of an excited-looking Shiba Inu considered one of the internet's most iconic and renown memes, has sold as a nonfungible token, or NFT, for $4 million by auction winner, @pleasrdao; Getty Images

Are NFTs here to stay?

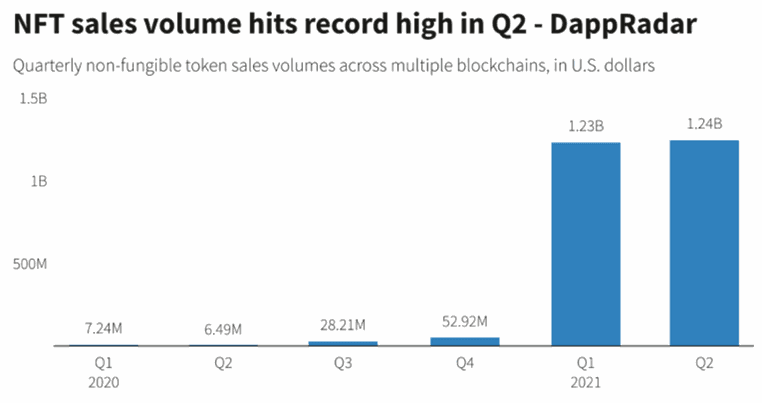

There has been much debate in the art world regarding whether NFTs are a temporary craze, or a new integration of the art market that will stand the test of time. Current trends are demonstrating that the appetite for NFTs is increasing, however, as the second quarter of 2021 boasted record high sales, bringing in $1.24 billion.[2]

Figure 1: Reuters

Francois Toussaint, founder and CEO of ARTTs, a peer-to-peer marketplace that allows artists and art collectors to trade NFTs, believes that the market will evolve and become stable in the next 3 – 5 years. ‘The technology of having digital pieces that are impossible to copy and having this strong community of people into collectibles is unique and disruptive,’ he states, ‘Now we are seeing a mix of physical and digital models.’ Indeed, ARTTS has the goal of introducing the NFT market to traditional art lovers and collectors, allowing artwork acquisitions to become more accessible. Working closely with galleries, museums, and artists, ARTTS proposes another way to look at art and NFTs via strong storytelling. With audio-visual storytelling, interviews, and expert talks, NFT art collectors can build deeper connections with the art they collect, which just may be the emotional bridge necessary to integrate the NFT market into the traditional art world more seamlessly.

How can NFTs empower the African art market?

One of the most empowering aspects of NFT technology is the ability for artists to receive royalties when their artworks are resold. Current NFT platforms pay artists a royalty (usually 10% of the resale price), when collectors resell their artworks on the secondary market. As NFTs are built on the blockchain, these secondary transactions are transparently recorded, and each resale can be traced. Unlike in the traditional art world, where artists almost never see a paycheck for the resale of their artworks at auction, the transparent recordings on the blockchain means that it is much harder for NFT creators to be cut out from the equation. Though there are methods to evade or undercut this system, the idea of artists being paid royalties for their works is finally being put into effect with the NFT art market. Once intellectual property rights are stabilised for the NFT ecosystem, this approach has the potential to revolutionise the current secondary art market at large.

For African artists, this boasts many benefits. Firstly, artists can technically bypass the traditional art world system altogether, cutting out middlemen such as art dealers or art galleries. In this way, the reliance on Western mega galleries and major museums for validation and recognition is displaced, and artists can get paid full price for their creations without having to split hefty commissions with a third party. For African artists who don’t have as much access or exposure to the centralised art markets in London or New York, selling NFTs thus becomes a viable means of living off their art. Not only that, but as artists can be paid royalties for each resale of their artworks, a collector from another part of the world cannot monopolise the African NFT market by buying out all the collectibles of a particular creator, and then resell them without the artist receiving a cut of the sale.

In addition to this, platforms such as ARTTS provides a means for collectors all over the world to gain access to art markets and regions that they typically may not be able to reach. Described as ‘an open Museum for art lovers around the world,’ ARTTS’ diverse offering of artists and their dedication to sharing the stories of the artists and artworks means that African creators can also be highlighted and shared in a unique way. International collectors will be able to learn more about contemporary African art, digital African art, and individual African artists, as well as support and empower their careers by collecting their NFTs. All in all, the democratic and more accessible nature of NFTs and blockchain technology could be another important element that the ‘African’ art market needs to reach the next level of its continuous growth.

[1] https://www.forbes.com/advisor/investing/nft-non-fungible-token/

[2] https://www.reuters.com/technology/nft-sales-volume-surges-25-bln-2021-first-half-2021-07-05/